I'll Wait Until The Market Improves

- Mark Lukes

- Jul 13, 2023

- 4 min read

A statement we’ve heard a number of times lately from broker/owners who are thinking about selling is “I think I’ll wait until the market improves.” And it’s understandable for sure. For some they’re seeing a resurgence in business, for others, there’s a number that they “need to get” to achieve their retirement desires and still others are simply holding out hope that things will (they MUST) get better.

This time of year, especially, it’s natural for owners to not want to distract themselves by trying to sell their business. There’s a natural uptick in business. We’re in the season. That’s the cycle and we all know it. However, it almost seems like every year we forget it. By and large, business is not “better” right now, it’s just better than it was before summer began.

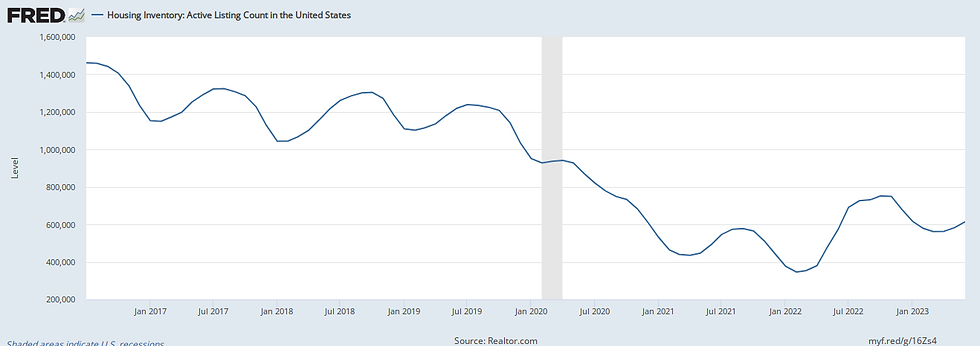

Perhaps this chart will help illustrate the point. This shows housing inventory (in thousands) over the past 10 years. From the peak on this chart (July of 2016) until the current data (June of 2023) there’s a 58% decline in inventory. You don’t have to be told this, you feel it already.

Are we better than the past few months? Sure. Are we better than last year? Slightly. Are we anywhere close to “normal”? H*** no. And yet the same old cycle continues. We’re going to see a bump, then we’re going to see a trough. How much of a bump and how deep of a trough is speculation but one could safely say that the bump won’t be too high and the trough will likely be lower than any of us wants to see. Don’t mistake the normal cyclical inventory as a sign that “things are getting better.” Things are doing what they always do.

The other thing we’re hearing from many brokerage owners is that sales are down anywhere from 18% to over 25% year-over-year. Of course prices have also been up to counterbalance some of that, but the impact of that depends on your commission model. Fewer transactions regardless of your model is going to mean less business to go around. And in nearly all markets around the country prices have begun to level and even cool. Yet, still, there’s a desire to “wait until the market turns around.”

No surprise as you look at what we’ve seen from mortgage rates in the past ten years. From its lowest point (January of 2021) of 2.65% to the current point (June of 2023) at 6.81% average, there’s been a 157% increase.

So we’re in a normal cycle on one hand, and an abnormal trough on the other. Less inventory, fewer transactions, higher but cooling prices and significantly higher mortgage rates. But even these data points coupled with a lot of head nodding and agreement, there’s still a wait-and-see sort of attitude. And don’t get us wrong here, we’re not trying to convince anyone that they SHOULD sell. We’re simply trying to help make the point that, if you’re ready to sell, waiting isn’t going to help.

Which brings us to this. Rather than continue to try to illustrate what’s happening in the real estate world and why it’s not good, we decided to take a look at the effects of the market on company valuations. The results are fairly shocking.

Before diving into the details in the real estate world, though, it’s worth noting that this is NOT isolated to real estate brokerage. Every valuation is down. Capital is drying up. Venture firms are retreating, Private equity companies are sitting on the sidelines. But there is some good news. As you can see on the chart below, courtesy of PwC, overall deal volume (across all industries) has leveled off and even picked up slightly. More importantly, though, deal values have started to stabilize. Yes, they’re down dramatically from 2021 highs, but they’re stable.

As for the real estate industry, we’ve seen a similar trend. Specifically, if you look below, we have taken the past year’s worth of data based on the typical valuation multiples (the multiple of EBITDA that represents the value of your business to a purchaser) we’re seeing. What you see here is the average valuation multiple on deals by region across the U.S. Overall, the average decrease in multiples has been 20.5% since Q3 of 2022. Of course, not all areas have been hit as hard but California and Arizona, for instance, have seen declines of greater than 30%. While Florida and Georgia have seen more modest declines of just over 15%. Still, everywhere has declined. It’s worth noting that much of the slide has occurred over the past five months. You can, however, see a leveling.

Now, back to the matter at hand. Do you still want to wait? There’s one more thing we’d like to illustrate. Below is a valuation range for a California brokerage. Small but profitable with an average EBITDA of $317k over the past four years. As a result of all of the factors we’ve already discussed and the decision to “wait until the market gets better”, the result is a 32% decline in value.

Comments